EIIA Membership for ABACC Members

Insurance and Risk Management Exclusively for Private, Faith-Inspired Colleges, Universities, and Seminaries

About EIIA

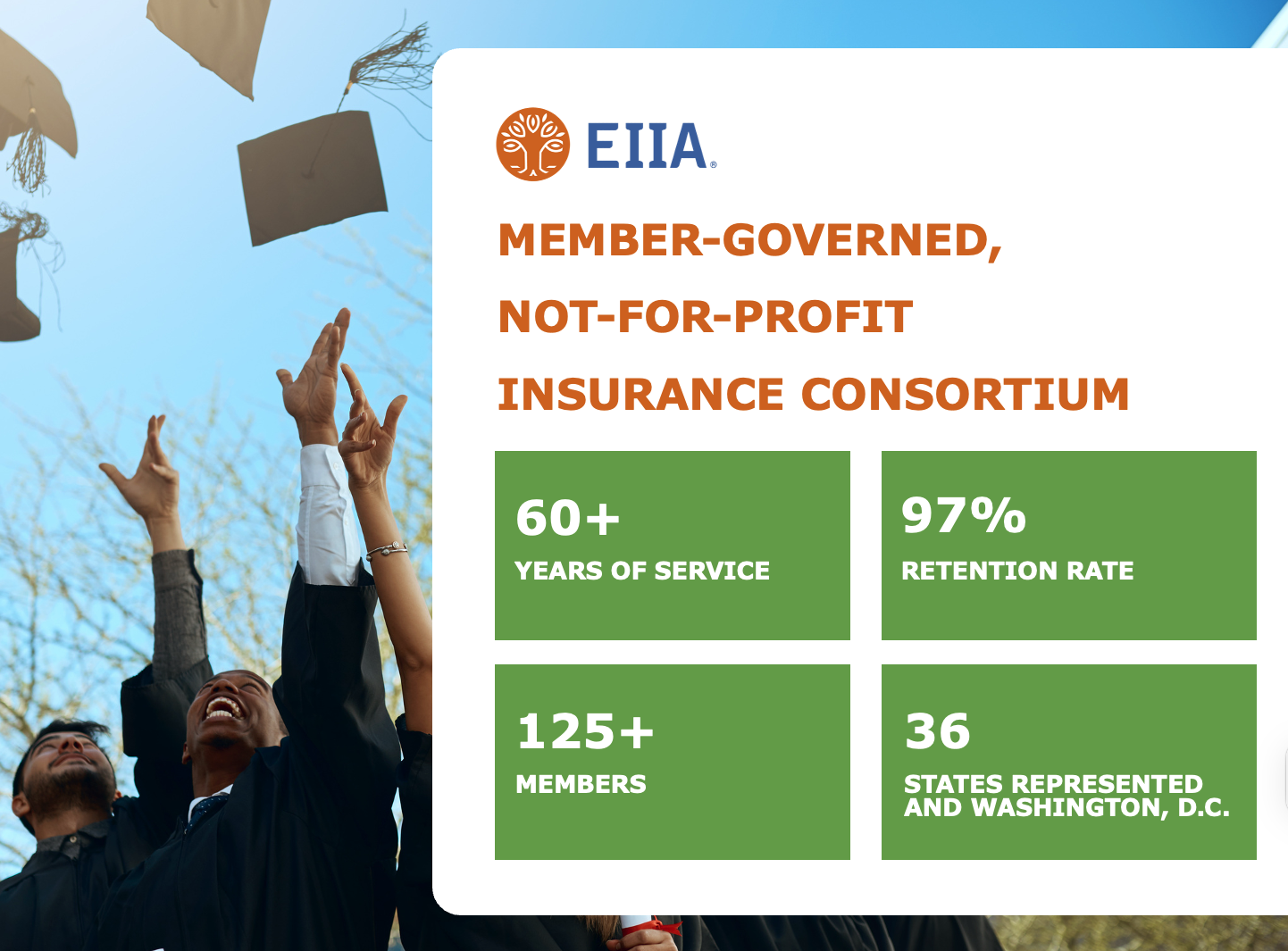

Educational and Institutional Insurance Administrators (EIIA) is a Member-governed consortium of private, faith-inspired colleges, universities, and seminaries committed to protecting the promise of higher education through the delivery of innovative insurance and risk management solutions to its Members.

Partnering. Preparing. Protecting.

- Fortune 200 scale with a not-for-profit commitment

- Ownership power that drives lower costs and stronger institutions

- Drop everything service and expertise designed to support Members’ success

- Higher education insurance specialists prepared for tomorrow’s challenges

Frequently Asked Questions

- What is EIIA?

Educational & Institutional Insurance Administrators (EIIA) is a member-owned, not-for-profit insurance consortium serving private, faith-inspired colleges, universities, and seminaries.

- EIIA operates two primary lines of business:

1. Property & Casualty insurance, which includes risk management services

2. Student insurance programs designed specifically for higher education.

- EIIA operates two primary lines of business:

- How does the consortium model work?

Rather than each institution entering the insurance market independently, EIIA’s Members participate collectively. The consortium pools risk, aligns incentives, and engages the insurance marketplace at scale.

EIIA represents more than 125 institutions with insured property values of over $34 billion. This collective presence allows EIIA to negotiate coverage and terms more effectively while remaining directly accountable to its Members through member governance.

- How is EIIA different from working with a traditional carrier or broker?

In a traditional model, institutions typically purchase coverage annually and are exposed to market volatility at each renewal. EIIA’s consortium model is designed to smooth that volatility over time.

EIIA is not a broker earning commissions and not a for-profit carrier focused on underwriting margins. Instead, EIIA is governed by its insured institutions and structured to support stability, stewardship, and sustainability.

- What does EIIA provide through Property & Casualty coverage?

EIIA provides comprehensive Property & Casualty insurance tailored specifically to higher education, with risk management services built into the program, not added on.

Members work directly with Risk Management Directors who understand campus operations, regulatory requirements, and emerging risks. Support includes risk assessments, loss prevention guidance, training, and ongoing consultation, all designed to reduce claims frequency and severity over time.

- How involved is EIIA when a claim occurs?

EIIA remains actively involved throughout the claims process. Members receive hands-on claims advocacy and coordination from professionals who understand higher education exposures and institutional context.

This approach helps institutions navigate claims more effectively and reduces the burden on campus leadership during high-impact events.

- What student insurance programs does EIIA offer?

EIIA provides student insurance programs that are designed specifically for higher education environments, including health and related coverage options that align with institutional values and student needs.

These programs are flexible and tailored to each campus, allowing institutions to support students while maintaining consistency with institutional mission and compliance requirements.

- How do Property & Casualty and Student Insurance work together?

Both lines of business are supported by the same philosophy of partnership, stability, and hands-on service. Institutions benefit from working with one organization that understands campus risk holistically, from facilities and operations to student well-being.

For many Members, this integrated approach simplifies administration and strengthens alignment across campus stakeholders.

- How long has EIIA been serving higher education?

EIIA was founded more than 50 years ago when six United Methodist–affiliated colleges were denied affordable insurance. Today, five of those founding institutions remain Members, and 48 percent of EIIA’s Membership has been with the consortium for more than 25 years.

That continuity reflects a model built for long-term partnership rather than short-term transactions.

- Is EIIA membership open to all institutions?

EIIA membership is intentionally selective. This allows the consortium to maintain a strong risk profile, remain hands-on, and ensure alignment across the Membership.

Institutions invited into conversation are typically identified as strong potential fits based on mission, structure, and risk characteristics. Initial discussions are exploratory and focused on mutual fit.

- What is the next step if we want to learn more?

The next step is a conversation. EIIA takes time to understand each institution’s goals, risk profile, and priorities before discussing membership.

If you are attending ABACC, we invite you to visit Booth 205 or schedule a time to connect during the conference. If not, you are welcome to connect with us to explore whether EIIA membership is a good fit by emailing Doug Avrin, Vice President, Property & Casualty, at davrin@eiia.org